Sea is for Cryptocurrency

What The Outlaw Sea can teach us about risk: Micro and Macro Hacks; Cyber Coverage; Cyber Financing; Commodity Commons

Apologies for the coming in a day late again. Still getting settled into my new place, but next week I’ll return to my regular schedule, and the book I’m writing about is an exciting one!

“… When every last patch of land is claimed by one government or another, and when citizenship is treated as an absolute condition of human existence, the ocean is a realm that remains radically free.”

- William Langewiesche

Risk Developments this letter:

Micro and Macro Hacks

Cyber Coverage

Cyber Financing

Commodity Commons

The Sea and the State

The subtitle of “The Outlaw Sea”, “A World of Freedom, Chaos, and Crime”, could just as easily apply to a book about cryptocurrency as to one about international waters. As a book about life at sea, it accomplishes its goals to entertain and inform, and as an allegory for the limits of institutions, it is a powerful argument. This argument also explains why I’m bullish on cryptocurrency, but still don’t own any. When co-founder of Venmo and Fin Analytics, Andrew Kortina gifted me the book, I knew I had to read it!

The book is a set of anecdotes woven together by author William Langewiesche, who starts with an overview of what the system of international waters is and how it functions. Here he draws on interviews with the coast guard, port administrators, pirates and sailors to describe an semi-anarchic system that is ostensibly self governed by the International Maritime Organization (IMO), a special agency of the United Nations, but in practice, one that is pressured, influenced and cajoled by military and financial interests. The first third of this book focuses on organized crime, terrorism and other stateless threats. The primary anecdote for this section follows an organized criminal venture in Southeast Asian waters off the coast of Indonesia, where a Japanese bound shipment of aluminium is stolen and later recovered by the Indian Navy.

The book is anchored by the main anecdote in the middle third of the book, that deals with the sea as the space between nation states. Through a set of harrowing firsthand accounts, legal documents and a sensationalized fictional retelling, we learn about the sinking of the MS Estonia. The story is about how the fall of the Soviet Union, combined with complicated economic relationships and vulnerable legal systems, caused the greatest naval catastrophe since 1987. The Estonia was a ferry and cruise ship operating in the Baltic Sea between Estonia and Sweden, carrying just under 1000 people, of which only 137 survived. Its sinking caused international outrage and in response the governments of Estonia, Sweden and Finland created the Join Accident Investigation Committee (JAIC). The JAIC report blamed the shipbuilders, who in turn blamed the ship operators, and ultimately, the overly politicized commission was ineffective, except at creating more paperwork and new lifeboat regulations.

The final third of the book deals with the end of a ship’s life, focusing on the Alang, India, a coastal town of under 20,000 inhabitants, nearly all of whom are migrant workers employed in the shipbreaking industry. Here, wealthy nations dispose of their ships amid dangerous working conditions and environmental blight. Ships, birthed in the drydocks of nation-states, spend their lives outside of the safety and paternalism of sovereignty, returning to nation-state controlled beaches to be carved up and sold off as scrap metal. The process of deconstructing a ship can expensive and cumbersome, so entrepreneurs in developing countries turned their misfortune at being born in a country with weak civil institutions into fortunes. In an interesting comparison, Alang, India and Baltimore, U.S.A. are juxtaposed. The U.S. Navy, facing mounting repair costs to maintain derelict ships and constrained by EPA export restrictions, decommissioned four ships in Baltimore at a cost of $13.3M. Countries with permissive labor and environmental protections will take any ship that can make it to their shores and the shipbreakers pay for the right to disassemble them. Langewiesche concludes, “Shipping is like the larger world in which it operates—an inherently disorderly affair, existing mostly beyond the reach of nations and their laws…”

Cryptocurrencies, like ships, originate within the confines of a legal system. The inputs they require, energy and integrated circuits are complex to produce and controlled by nation states. Once these digital abstractions have been mined, they set sail on the open web, passing through registries (wallets) and flying whichever “flags of convenience” best suit their purposes. Here they glide, frictionlessly, from port to port amid traffic so dense it obfuscates their purpose, ownership or origin. That is not to say (at least in bitcoin’s case) that concerted effort cannot determine the provenance of one ship or digital token, but as one Coast Guard officer put it, “We’ve got thirty million boats out there…. Can you imagine how we’d have to turn down the gain?” The more interesting question is how cryptocurrencies come to rest. They are not taken out of circulation, like ships, but they do come to land, ultimately upon the shore of a nation-state, when they are exchanged for fiat.

In a recent interview, Coinbase CEO, Brian Armstrong, is pressed by Tyler Cowen on where the value of cryptocurrency comes from:

COWEN: I don’t know exactly who, but someone else has less purchasing power, right? Bitcoin isn’t apples. You can’t eat it for lunch. If I find some bitcoin, clearly, I’m better off, but I’m commanding resources that would have gone to other people, and it’s not clear where the efficiency gain arises that’s giving someone somewhere in the system more apples.

ARMSTRONG: It’s not clear to me that bitcoin is a zero-sum game. Something new of value has been created, which is that we now have a global, decentralized value — and with other cryptocurrencies, of course, because it’s not just about bitcoin now. We have medium of exchange. We have security tokens, smart contracts. This is actually driving a lot of innovation and new value, I would say. It’s not clear to me it’s zero-sum. I think there’s something inherently of value that probably made people, net, better off overall there.

COWEN: But what is that? When do I get my apples, so to speak? Where do they come from?

ARMSTRONG: Well, anybody can participate of course. I’m not sure I’m answering your question super directly, but yes, of course, anybody can participate in this global, decentralized network, and it’s there to benefit anybody who wants to use it. I think, now, about probably 10 percent of Americans and maybe 60 or 70 million people globally have crypto, at least. So it’s been growing a lot.

This is not exactly a satisfying answer, and as the CEO of a newly publicly listed company, I can understand why he is hesitant. There are, of course many answers here, most interesting is Layer1 founder, Alex Leigl’s answer given to Byrne Hobart on a recent The Diff subscriber call. Bitcoin, as a consumer of energy, smooths out notoriously spikey energy demand. This increases the cashflow created by intermittent energy producers, who traditionally only turn on to capture the high energy prices, but can now mine bitcoin in the meantime. Having a store of ready energy production, is better than a battery because there is no energy loss and it makes marginal energy projects, like renewables in some cases, viable.

The endgame here is for bitcoin to be the global energy standard, the way oil is today. Oil tankers are a way to transport energy anywhere in the world, despite the expense and difficulty of maintaining an electric grid and/or natural gas pipelines. If energy markets become priced in bitcoin, as oil markets around the world are priced in dollars, you will be able to take excess energy off the grid in Texas and spend it on electricity in Tokyo. If an energy producer is mining bitcoin with its power supply, they should be indifferent between mining or selling that power for bitcoin. Still, saying “cryptocurrency is valuable because it costs energy,” begs the question.

We know energy is valuable and we know it takes energy to mine cryptocurrency, so the question is not, “Can an energy producer sell cryptocurrency?” but “Can an energy producer buy all the inputs it needs in cryptocurrency?” This is a harder question to answer. Comparative advantage between ports means ships always have something to put in their holds in both directions, even if demand is less on one route than the other. The alchemy of turning cryptocurrency back into energy requires that energy producers want cryptocurrency in the first place. Inputs for renewables like turbines, photovoltaic cells, steel and cement are not priced in cryptocurrency (yet), and furthermore taxes, which any energy producer will always have to pay, are priced in government money.

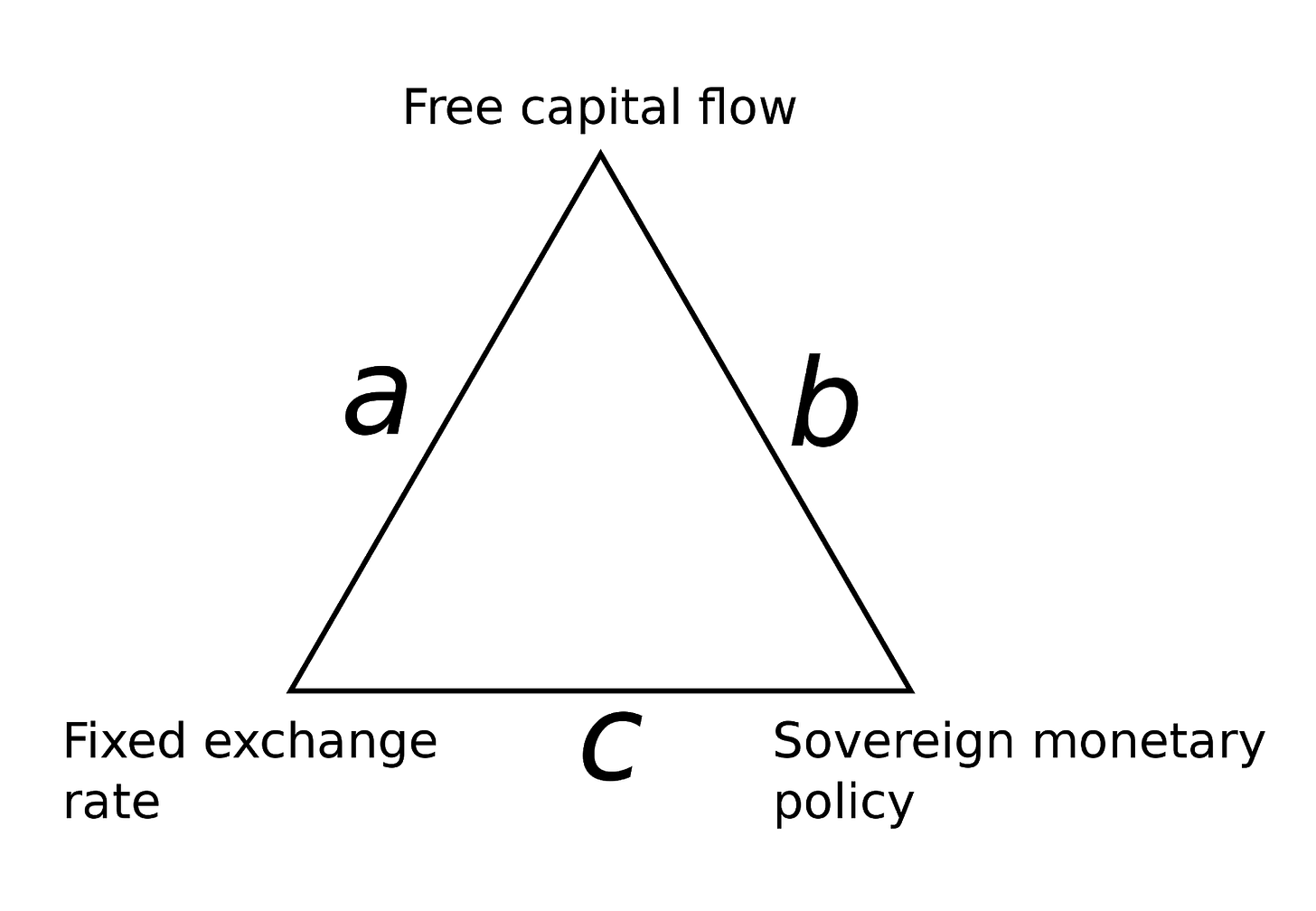

So here we are, beached on the shores of the nation-state and run aground by the international finance trilemma (a topic we’ve discussed before). As long as countries can borrow in their own currency, they will require payment of taxes in that currency. So what then is the scrap value of cryptocurrency? In Alang, we learn that ships are torn apart to have the steel sent to rerolling minimills that produce low quality steel rebar for the booming Indian construction market. In Baltimore the legal system created a much more lucrative business to dispose of ships in a way that did not harm workers or the environment. Similarly for cryptocurrency, it is not the inherent value, but the regulatory arbitrage opportunity created by nation-states. As a rule, countries prefer to borrow in their own currency (EU members foolishly gave up sovereign currency and most have regretted it ever since). Export led countries prefer a stable (and low) exchange rate, meaning they must implement capital controls. This is felt particularly acutely in China and Russia, two big exporters with wealthy citizens distrustful of government. The citizens of these countries who want to get wealth out are the ship-breakers of cryptocurrency. The residual demand will always exist as long as people in Russia and China want to get more value out than their governments will allow.

This is not a point that many people like to make or to accept, but it is the backstop to cryptocurrency value and it is one of the reasons the United State government is hesitant to remove this thorn in the sides of their adversaries. Being long cryptocurrency leads one to believe all sorts of potential uses, and Brian Armstrong provides a number of hand wavy explanations as do all of my cryptocurrency advocating friends (don’t hate me, please), but oftentimes many possible explanations is a tell. Any new technology, even a general purpose technology, needs a killer app. The good news for cryptocurrency is that there is one, the bad news is that some governments hate it.

I applaud the rise of cryptocurrency and as a technology enthusiast, I am hopeful for the potential of smart contracts, decentralized autonomous organizations, micropayments or other innovations that cryptocurrencies could enable. At the same time, I have little use for cryptocurrencies, at least for as long as I am not worried about capital controls. The existence of cryptocurrency offers a way out for anybody who feels trapped by their system of government. For those that believe in self determination, this is a good thing! Still, I don’t personally feel trapped, so while I am rooting for bitcoin and other cryptocurrencies, I don’t have much use for them yet, but the best way to keep government from growing tyrannical is competition.

The value of cryptocurrency may, in the end, accrue to all of us who accept living in a nation-state, and that’s a good thing! You don’t have to buy cryptocurrencies enjoy their benefits, but if nobody buys cryptocurrencies, the world will be poorer for it. Many cynics may get rich if cryptocurrencies keep rising, and some unlucky paper hands (🧻🤲) may lose money when the cryptocurrency market corrects, but true believers aren’t going to convert their cryptocurrency back into fiat anyway, and that is the more interesting thing. What do you do YOU want to do with cryptocurrency besides buy money?

Risk Developments

Micro and Macro Hacks

Last friday news broke that the Microsoft Exchange Server product had been hacked. Microsoft sells self-hosted exchange software to hundreds of thousands of customers, although it also competes with it’s Microsoft Online, hosted solution, which is also part of the popular Microsoft 365 cloud office bundle. This is already a wider hack in many ways than SolarWinds, and the numbers keep growing, but it’s not as deep a hack.

For one thing, SolarWinds’ products were administrative tools, that gave deep network insight and access that attackers could use to embed persistently and move laterally. For another thing, many sophisticated and sensitive clients have already moved to a managed email exchange, meaning that many of the 250,000+ affected customers are small businesses and local governments running legacy systems. Still the Biden administration is taking this seriously.

This hack also differs from those on SolarWinds in that it is attributed to the other main U.S. cyber adversary, China, not Russia. It has the hallmarks of a Chinese campaign, less sophisticated, noisier and mass targeting. Russian nation-state hackers, as a generalization, have the capability to plan long term operations targeting specific critical systems for the purpose of achieving a certain objective. China has historically operated opportunistically, working smarter, not harder. It’s the difference between pirate trawling a well traveled trade route for easy prey and privateer with a letter of marquee authorized for a specific goal. Neither are good, but so far nobody is being charged hostis humani generis.

Cyber Coverage

Ransomware is up, limits are down and brokers are getting squeezed. One big challenge is that there hasn’t been widespread agreement about what is covered by cyber insurance and what isn’t. Many legacy general liability policies seem to provide some cyber coverage, a risk that underwriters call, “silent cyber.” Stand alone cyber policies would not only clarify coverage, but also create a new income stream for brokers, carriers and reinsurers, it’s no wonder the industry wants more cyber specific policies.

Still, the insurance industry has a weird adoption curve. Brokers sell the most policies after a high profile catastrophe, but a catastrophe of that size may scare away carriers. It’s a similar phenomenon to liquidity in exchanges. Liquidity always disappears when you need it most. Therefore, discipline and a long-term view can pay handsomely to those who don’t capitulate to market pressure before an event and hold their beliefs after an event.

One space that has seen a positive event over the last few months is cryptocurrency. We’ve discussed the reluctance of insurers to deal in the cryptocurrency space before. Now broker Aon is jumping in with Nayms, a smart contract provider, to pilot cryptocurrency insurance for Teller Finance, a lender operating a decentralized protocol, and underwritten by Relm Insurance Ltd. Like international waters, insurance will become the defacto regulator in cryptocurrency, if the space stays beyond the reach of the nation-state, but within the realm of property.

Cyber Financing

Two big cybersecurity finance moves happened this week. First, Synack, which has created the world’s largest network of freelance white-hat hackers, by offering testing tools for them to coalesce around, raised $300M from venture firm Accell and hedge fund Tiger Global. Their skyhigh valuation pitches them as a SaaS company, but given that their value is more in the people than the software, that may not be true. Still 75% of the cybersecurity market is services, so they have a much bigger addressable market than most software security companies. Justifying their $4.7B valuation is a matter of market share and margin. If cybersecurity is an orderly cleanup, more like decommissioning a ship than scraping it for parts, than margin shouldn’t be hard to justify. Market share will come down to just how differentiating their tools are.

On the other end of the spectrum, cybersecurity a old-timer, Mcafee, is selling off its enterprise software business to a private equity buyer to focus on consumer and personal security. The consumer security market has always been tough for any business except antivirus vendors, especially those with broad name recognition. This deal definitely has the feel of a decrepit supertanker pulling up at Alang beach and being stripped of any valuable remains.

Commodity Commons

In non cyber news an interesting story about commodities theft came to light. The first is an entertaining tale of a trader buying $36M of copper, only to have copper painted pavers delivered. Not only was the deliver fraudulent, but it turns out the insurance policies, which would normally cover the fraud, were also mostly fraudulent, leaving the trader to take the matter to the courts. So far 13 people have been arrested in Turkey. Shipping containers and insurance contracts are abstractions that allow for mass transportation across ungoverned spaces, but these abstractions also create vulnerabilities to exploit.

There is an analogy here between analog and digital systems that I did not make above. Containers and digital containers. Certificates and digital certificates. Vulnerabilities and, well you get the idea. As with all analogies, this one is imperfect, but at least it’s useful. The reason it’s useful is because these are all tragedies of the commons. Other examples are public health, climate change, nuclear waste, space exploration, etc. The inverse of the tragedy of the commons is stone soup, or a schelling point. Being part of something, working together and believing in the same story is what makes these abstractions work. The opportunities and risks are determined by whether we see open space as a place to create new stories or a battleground between existing ones.

Gratitude

Big thanks to Andrew Kortina, Alex Liegl, Byrne Hobart, Tyler Cowen, Brian Armstrong, Benjamin Dean and others for sharing your ideas with me!