Forgive Us Our Debts

Lies, Myths and Lore about the roles debt plays

In fact, our standard account of monetary history is precisely backwards. We did not begin with barter, discover money, and then eventually develop credit systems. It happened precisely the other way around.

Debt: The First 5000 Years, by David Graeber

We have been lied to. Debt is not the natural solution to the double coincidence of wants. If you have taken an Econ 101 class, you were no doubt taught this mythology, but the truth is more interesting and illuminating that we even imagine. Debt’s origins are more mystical than its quotidian function implies.

What are the origins of debt? Debt originated in the temple complex at the nexus of the political, religious and economic power. The oldest writings we have are accounting records of debts, which predate the widespread use of currency and generalized written language. Our conception of debt, as either a modern financial tool or a moral obligation, both come from made up justifications passed down by oral traditions fabricated long after debt entered, or possibly created, civilization.

The Truth About Debt

Debt is a mystical device for shifting value across time. If you conceive of debt as a symbolic form of time travel, things begin to fall into place. This back to basics conception of debt is made apparent by the various ways we use the word debt.

Fiscal Debt

Fiscal debt is a tax advantaged form of financing. This is what most people think of when they think of debt. They think of household or corporate debt, because it is the debt they are familiar with, but even these two forms of debt are not equal. As households we usually fear debt. It curbs our freedom, restricts our choices and puts a ceiling on our futures, but it is also what allows people to buy shelter, education and mobility necessary to earn income throughout their lifetime. Still, we are justifiably wary.

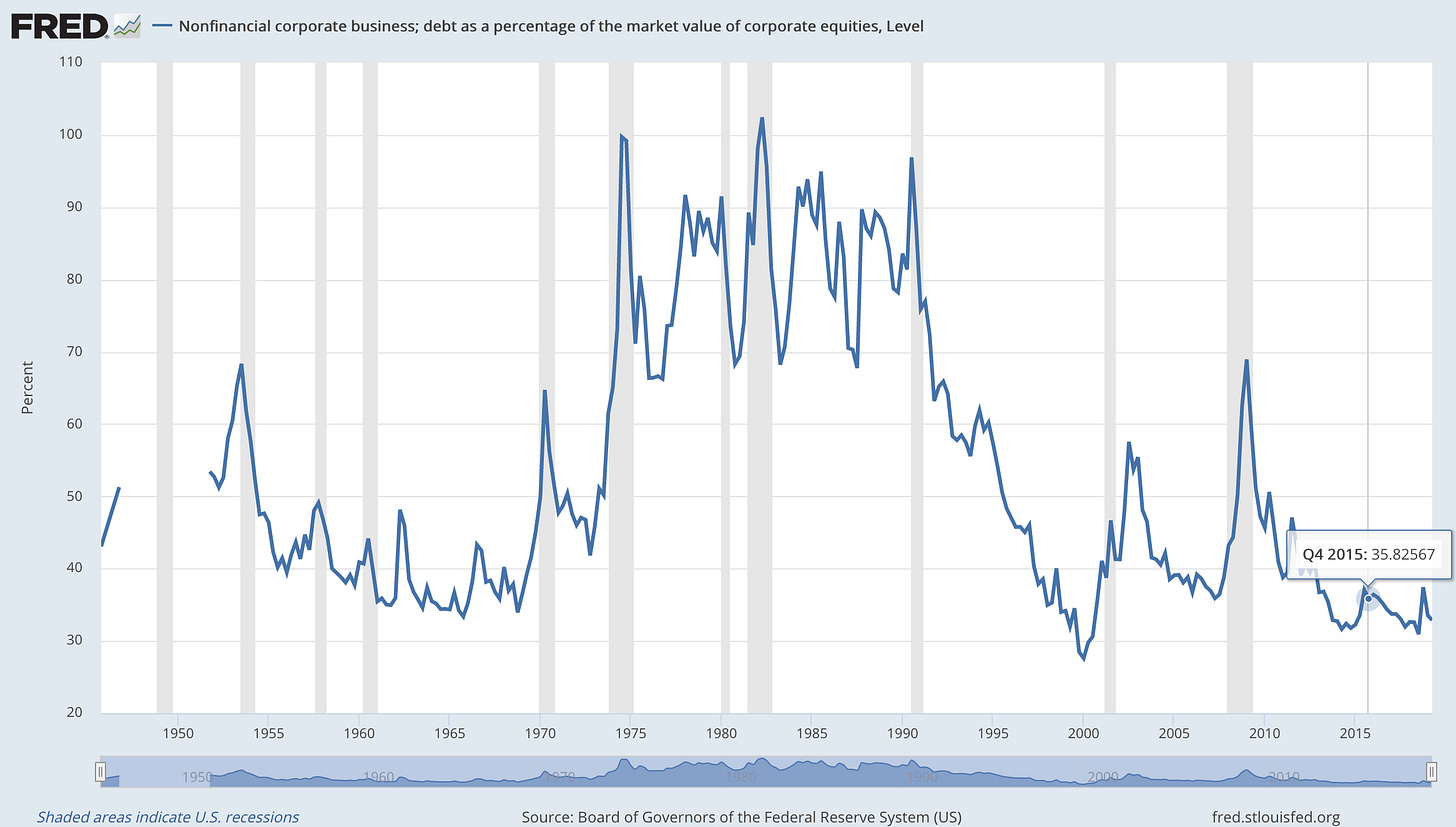

Businesses are different. For businesses debt is a talisman use to produce growth. It is the most expedient and often cheapest form of financing. Relative to equity or retained earnings, debt caps the financier’s upside and accelerates the rate of investment one can make in a profitable business model. As learned in corporate finance classes in business schools across the globe, companies have an optimal capital structure, that is, an ideal ratio of equity and debt. The leveraged buyout boom (as shown above in the 1970’s-1980’s) led to increased leverage, which came to an end with the culmination of the S&L Crisis and the fall of Drexel Burnham. Corporate raiders employed debt to transform future profits into the present acquisition capital.

Considering debt with the framing that is neither a replacement or barter or a moral obligation, allows us to see it as savvy business people do. It is a technology for time travel that requires the collective belief of humans to deploy labor and capital today for return on investment tomorrow. This additional collective belief piece is the key. Trust, collective intentionality and the sacred are all wrapped up together.

Monetary Debt

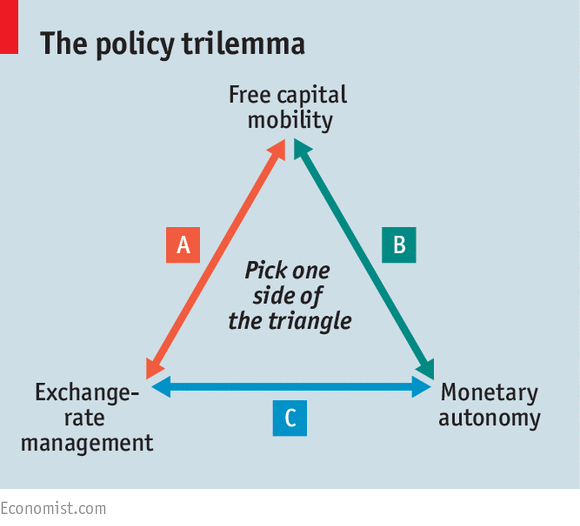

Monetary debt is the debt between and within (debt owed to a nation’s own citizens) sovereign nations. Countries that create their own money supply, have some control over the collective indebtedness of the individuals they represent. The international finance trilemma (below) states that if you retain monetary authority, you may have either no capital controls or a pegged exchange rate, but not both.

Therefore, countries that want to be able to manage their debts by borrowing in their own currency, must open their capital markets (capital account) or allow other countries to influence their trade through a floating exchange rate (current account). Countries that with to control how their citizens trade and invest globally, must give up their ability to borrow in their own currency.

Countries with monetary autonomy are borrowing real resources from the future through seigniorage. While the mechanism of debt is different at the macroeconomic level, the basic building blocks are the same. It is the combination of government mobilization of labor with capital that can create public goods, which provide excess returns for a population. An army offers protection by mobilizing labor and buying materiel, which provides national defense that allows for commerce, creating value far in excess of the costs of labor and materiel.

This coordinated activity is not so different than at the household level, except that countries may control their own money supply, and therefore have many more options for how to “spend” their future resources and make investments today. Countries with weaker bargaining power and monetary constraints rely heavily on international norms, treaties, NGOs and even cultural or religious ties to coordinate mobilization of labor in conjunction with capital. This is why you see deep ties between the U.K. and the United States, Syria and Russia, or North Korea and China. They are relying on their shared beliefs to mobilize labor and get access to capital, which allows them to shape the future in a way that provides a return in excess of the current investment.

Tech Debt

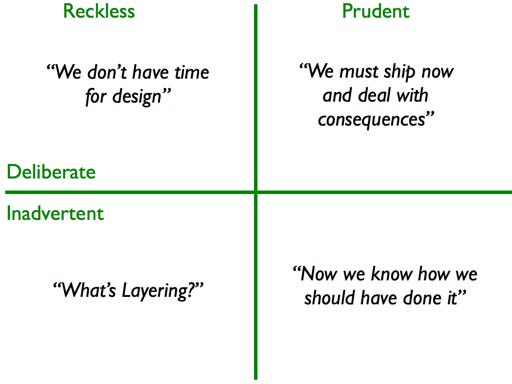

Technical debt is borrowing from your future labor. Sooner or later, you will have to refactor the code, and it will be painful, but by borrowing from your future self, you can invest the proceeds today to earn a return in excess of the burden you will incur. Martin Fowler describes the trade offs as reckless-prudent and inadvertent-deliberate.

For instance, a developer may select a design architecture or particular schema based on needs today understanding it will have to be changed in the future (prudent/deliberate) or without knowing that it will have to be changed (prudent/inadvertent). Engineers, to generalize, are oriented towards facts and are skeptical by nature. This makes them reticent to flights of fancy and the typical “tricks” that may work to mobilize labor for many businesses.

Furthermore, there is only one currency in the technical debt metaphor, and that is labor. Labor today or labor tomorrow. this is why Fowler struggles to find a useful example for prudent/inadvertent in financial terms. While the nature of creative labor is that something that has never been done before can be impossible to anticipate, the nature of capital is that if there are inadvertent costs, they are by definition not prudent. This is why creative financing is so viscerally unappealing.

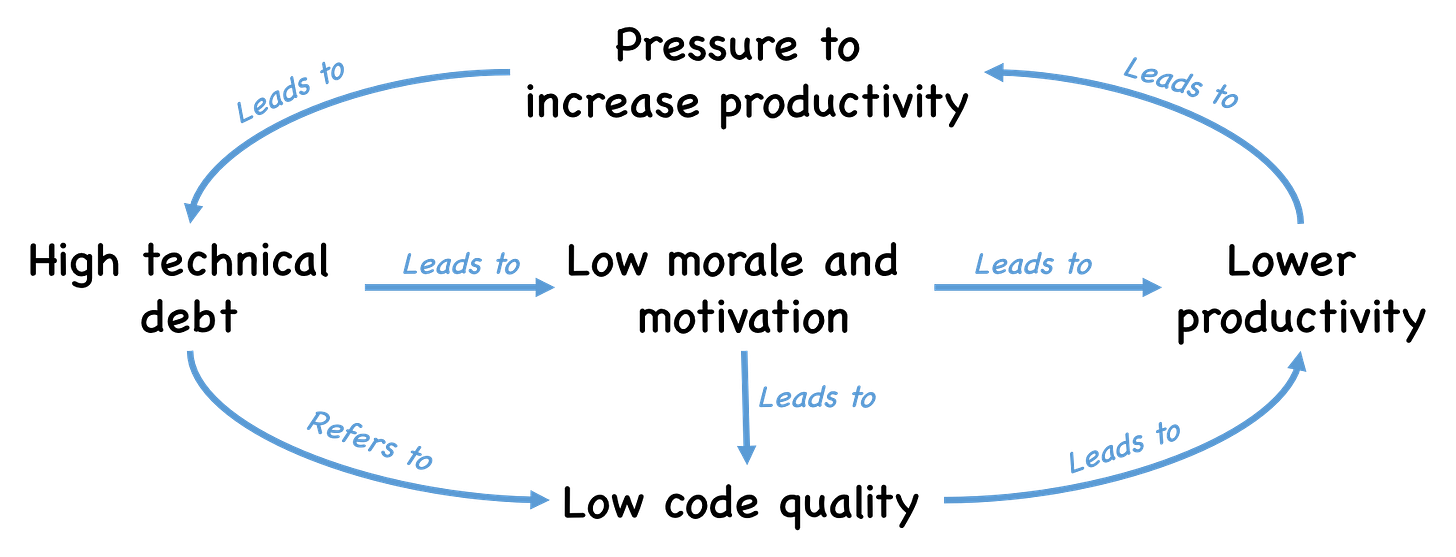

Technical debt is most clearly a version of time travel, but the sacred aspect may be less apparent. It is in product meetings that this mystical moment is born. A team of engineers, designers and business people come together to make feature and requirements decisions that inform the technical trade offs. It is not so strange then to see the role of product manager take on priest or cult leader like status. The ability to manage dichotomous and strong opinions to a point of near consensus without making bad choices that lead to poor future quality is pretty divine.

Changing Perspectives on Debt

Across these three domains, we use the word debt to capture an abstract concept that we all recognize at its core; capital over labor given time equals value. In fact, bankers even have a formula for this called a discounted cash flow. In finance the labor is abstracted away by a rate of return, but this is essentially ones ability to take raw capital and produce something with value in excess of the raw capital. This fundamental human understanding of what it means to create underpins all three types of debt.

It is this deep relationship to the coordination of people in groups to employ their synchronized labor that is so mystical. It is why people describe Steve Jobs in almost religious terms. It is why vision and inspiration is such a key aspect of how investors pick who to invest in, and it is how engineering teams go from opinionated and fractious to some of the most productive people on earth.

Putting the moral or technological versions of debt to bed and waking up to the symbolic nature of debt will help us get out of many debt traps.

We are already seeing a rethink of monetary debt as politicians are beginning to offer big solutions to massive problems without constraining ourselves today’s productivity rates.

Households and businesses can reassess their strengths and weaknesses by combining various specializations of labor under the instruction of a strong vision and inspirational leadership.

Finally, managers working with technologists and engineers may grow their appreciation for quality by understanding the symbolic nature of tech debt and its consequences for morale.

As voices rise to wipe the slate clean (to literally erase debts), we risk acting without understanding. The current climate should not be wasted on solutions that perpetuate today’s problems. Although, the tradition of debt forgiveness is an old and powerful one, as long as we’re still trapped in our current perspective of debt as moral obligation or technology, we won’t learn our lesson. The fresh github account will fill with cruft just as quickly as a household’s new credit card gets maxed out. It’s time for a fundemental reconcpetualization of one of society’s greatest innovations. It’s time to rethink debt.