Systems Thinking

What Akira can teach us about risk: Cyber Insurance, Crypto Regulation, Big Bank Crypto, Political Risk

It was too difficult for Tetsuo... of course, too difficult for us. And for Akira.

- Takashi

Risk Developments this letter:

Cyber Insurance

Crypto Regulation

Big Bank Crypto

Political Risk

Extra Systems Perception

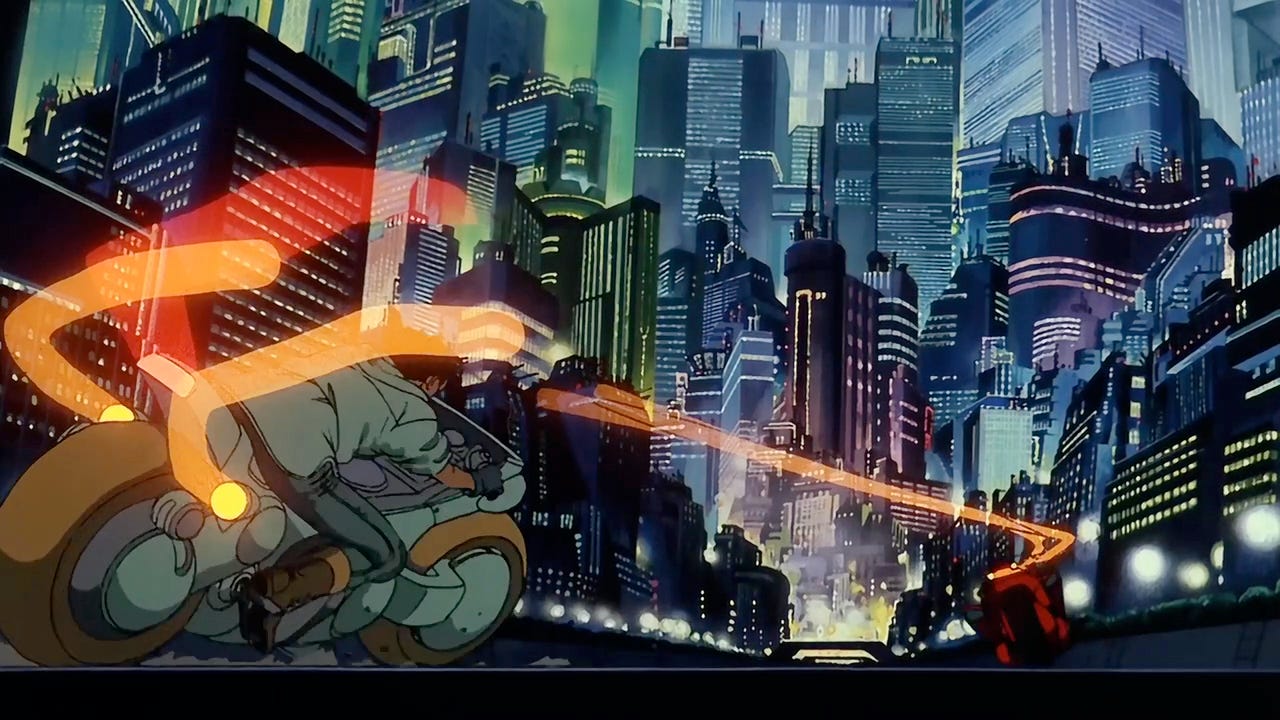

The anime cult favorite Akira changed the way the West viewed animation, introduced cyberpunk to the world and influenced a whole generation of artists. Just ask rappers Kanye West and Lupe Fiasco. This anime’s influence is wide reaching and genre defining, but why, and what can it teach us about risk?

To answer these questions we should first pay homage to the artistry and craftsmanship displayed throughout the film. From the score to the backgrounds, the painstaking work to produce 160,000 animation cels and even early computer-generated imagery, this work of art was the most expensive anime ever produced at the time. It’s not just visual and audio experience that is so impressive, however, but also the story. Based on a long running manga, published from 1982-1990, Akira defined the cyberpunk genre.

The basic overview of the plot is of a biker gang getting tangled up in a top-secret government experiment in psychic warfare. Set in the post WWIII, Neo-Tokyo, in the year 2019, Tetsuo Shima, a member of a biker gang, crashes into an escapee who fled a government lab where they were subject to extrasensory perception (ESP) experiments. When Tetsuo is arrested the authorities find out that he has powerful psychic abilities that are reminiscent of the mysterious “Akira.”

The remaining members of Tetsuo’s biker gang join forces with a resistance group to try to break him out. As they break in, Tetsuo’s powers are growing and the other ESP subjects attempt to kill him, fearing that his power is too great. Failing to assassinate Tetsuo, one of the ESP subjects tells him to seek out Akira, who may be able to help him control his powers. Meanwhile, the colonel who runs the ESP lab overthrows the government and marshals all military resources against Tetsuo.

In the final showdown, Tetsuo battles his former gang members and the military at the same time, which awakens Akira. From here things get even weirder and more metaphysical, but I’ll let you watch it and draw your own conclusions. Eerily, this showdown takes place at the 2020 olympic stadium (which were postponed in real life due to the pandemic). This climax is one of the better scenes in cinema, but the rising action is what is more relevant to our discussion of risk.

Part of what makes Akira so relatable is the world building that, despite its outlandish sci-fi elements, feels believable. The film does a tremendous job of rendering a chaotic system, one complete with feedback loops, reservoirs of latent power and flows of energy between these reservoirs. There is of course psychic power that seems to feed on itself, and state power that flows from civilian to military control, and rivalry between biker gangs, as well as a love story subplot, intense interpersonal relationships and existential breakdowns in society, coupled with a message of rebirth and hope.

All of this is to say, Akira is a great lesson in systems thinking. The steady states created throughout the movie are the result of chaotic and unpredictable events like a motorcycle crash. These inflections move the plot along from plateau to plateau, the same way change happens in real life. As soon as you are comfortable with the prevailing paradigm, it often shifts, and because of the interconnectivity of relationships within complex systems, the results are entirely unpredictable.

In risk disciplines, whether they are in finance, defense or technology, we are often confronted with the challenge of sensemaking. Understanding our world can only be done in retrospect with causal stories, but managing risk in real time is an exercise in acting with incomplete information. The lesson of Akira is not to fight the positive feedback loops or try to contain entropy, but to embrace it, ultimately benefiting from these societal phase changes.

Risk Developments

Cyber Insurance

The buzz about cyber insurance is that premiums are up, way up. Standalone policies saw prices jump 28% in 2020, only to be oustriped by a rise in claims of 38% over the previous three years. The U.S. General Accountability Office warned that premiums are likely to increase even more in 2021. This pain may turn out to be short-term, as insurance is a highly cyclical industry, punctuated by catastrophic losses. These losses are in turn followed by an influx of demand and sometimes, hopefully, better methods of cost control.

The biggest news in cyber insurance this past week, however, was not the rise in premiums, which have steadily increased over the last year, but the $40M payout that insurer CNA paid to cybercriminals who were holding the firm’s data ransom in March. This is the largest known ransomware payout to date, and a watershed moment for the industry. If nothing else, it’s also huge cryptocurrency news, alternatingly proving the value of bitcoin or demonstrating that it must be regulated, depending on your point of view.

Crypto Regulation

Speaking of crypto regulation… It appears the honeymoon phase is drawing to a close for the Biden administration. The IRS is getting a long awaited staffing bump to address cryptocurrency, which, despite the pseudonymity of Bitcoin and other cryptocurrencies poses a significant issue for at least one use case. The United States Federal Government seems to be taking the position that cryptocurrencies are ok for breaking Chinese or Russian laws, but not U.S. laws which makes the asset more like high end real estate than gold.

At the same time, Senate Democrat Sherrod Brown is pressuring the OCC on cryptocurrencies. This may create a schism between more traditional fintech and cryptocurrency fintech, but given some big bank enthusiasm for cryptocurrencies and their desire to block competitors from entering their legacy markets, it’s still unclear what stance legacy institutional powers will take in the debate.

Further complicating things is the OCC director’s stern words for fintech charters and big bank risk taking. Michael Hsu may be picking multiple fights at the same time, a difficult position to maintain, but one with the most flexibility. Like any complex system, the outcome is unpredictable, and sequencing will matter, because whichever battle the OCC picks first, win or lose, will create strange bedfellows for future fights.

Big Bank Crypto

Where are big banks falling on the cryptocurrency debate? Goldman re-announced its crypto trading desk this month and was recently considering offering crypto products to its wealth management clients. Wells Fargo is taking the middle path, offering crypto to high net worth clients, but not yet taking principal risk. On the other end of the spectrum, HSBC has no plans for crypto at all.

Part of the reason there is a diversity of approaches is that nobody yet understands where the chips will fall, but other reasons are institutional and business model based. HSBC already does lots of business helping wealthy asian private clients move money around the world. Cryptocurrency is a pretty direct threat to that. Other banks are less exposed to that risk and simultaneously more excited about the volatility in crypto markets. One way to model this might be to place banks on a spectrum of taking advantage of market risk on one end of the spectrum and political risk on the other.

Political Risk

Political risk is, of course, a massive topic in its own right, and one the effects not only finance, but geopolitics and technology as well. Issues from semiconductor supply chains to energy security are constantly subject to political risks. States (or would-be states) with strategic leverage in these critical markets can often punch above their weight.

Taiwan has been cozying up to the United States and Russia making friends with China. The recent efforts by Putin to play China off against the United States may bear fruit, if Biden follows through on his hawkish China talk, but political risk analyst, Isaac Fish Stone points out that Russia and China have an uneasy relationship of their own to manage. Systems thinking relies not only on the set of options available to actors in the system, but also on the degree to which other actors believe in the strength of those options. This results in continuous testing of willingness to exercise those options, creating yet more feedback loops.

One underrated strategy is to keep off ramps open, allowing actors to back down without losing face. In Akira, we see how committing to action can create an escalatory environment. When many dependencies create a web of interrelated events the outcome can be unanticipated disaster. Sometimes it’s best to go back to the start and wipe the slate clean. Tetsuo learns how to do this with the help of Akira, but in real life we may not get a deus ex machina to save us.

Gratitude

Big thanks to Alex Danco, Isaac Fish Stone, Anna Gat, and others for sharing your ideas that helped me write this piece!